Register for Self Assessment by 5 October

Date published: 22 September 2023

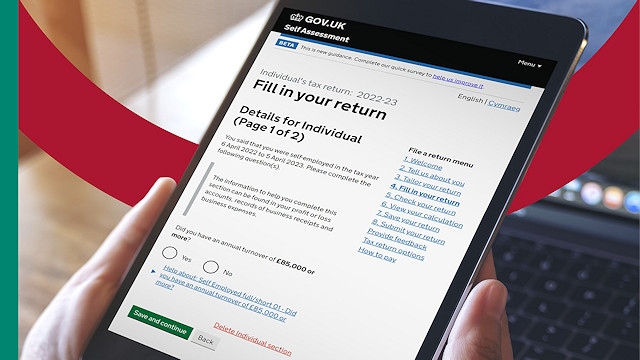

HMRC Self Assessment

HM Revenue and Customs (HMRC) is reminding anyone who is new to Self Assessment for the 2022 to 2023 tax year that they have until 5 October to tell HMRC and register.

New Self Assessment customers could be someone who has set up a side hustle to earn money in addition to their PAYE job or disposed of cryptoassets; they may be newly self-employed or a new landlord renting out property.

Whatever the circumstances, if a customer has any income earned between 6 April 2022 and 5 April 2023 that they have not already paid UK tax on, they need to register for Self Assessment.

Customers can use HMRC’s online checking tool on GOV.UK to quickly assess whether they will need to complete a tax return. And they can use the step-by-step guide to check what they need to do to file their first Self Assessment tax return.

Myrtle Lloyd, HMRC’s director general for customer services, said: “If you are new to Self Assessment and unsure how the process works – HMRC is here to help. We have a wealth of resources and guidance available on GOV.UK to help customers register, sign up to the online services and complete their tax return. We want to help customers get their tax right first time, just search ‘Self Assessment’ on GOV.UK to find out more.”

Customers can register for Self Assessment on GOV.UK. They will then receive their Unique Taxpayer Reference, which they will need when completing their return.

The deadline for customers to file their tax return online and pay any tax owed for the 2022 to 2023 tax year is 31 January 2024. And last year, 96% of customers filed their return online.

Filing online means customers don’t have to complete it all at once, they can save their progress and finish it later and have that added reassurance that HMRC has received their form when they press submit.

HMRC has a wide range of resources to help customers file a tax return including a series of video tutorials on YouTube and help and support guidance on GOV.UK. HMRC has also produced two videos to help customers registering online for Self Assessment for those who are self-employed and those who are not self-employed.

If customers think they no longer need to complete a Self Assessment tax return for the 2022 to 2023 tax year, they should tell HMRC before the deadline on 31 January 2024 to avoid any penalties or needing to complete a tax return. HMRC has produced two videos explaining how customers can go online and stop Self Assessment if they are self-employed and those who are not self-employed.

Customers need to be aware of the risk of falling victim to scams and should never share their HMRC login details with anyone, including a tax agent, if they have one. HMRC scams advice is available on GOV.UK.

Do you have a story for us?

Let us know by emailing news@rochdaleonline.co.uk

All contact will be treated in confidence.

Most Viewed News Stories

- 1Detective from Rochdale convicted of sexually assaulting colleagues

- 2Changes to council services over Christmas and New Year

- 3Rail travel advice calendar released for week over Christmas

- 4Extra £1m to be spent fixing Rochdale town hall clock and steps

- 5Andy Burnham "did not ask" for powers to overturn council decisions

To contact the Rochdale Online news desk, email news@rochdaleonline.co.uk or visit our news submission page.

To get the latest news on your desktop or mobile, follow Rochdale Online on Twitter and Facebook.