UK’s top 10 high yield buy-to-let hotspots revealed

Date published: 30 September 2014

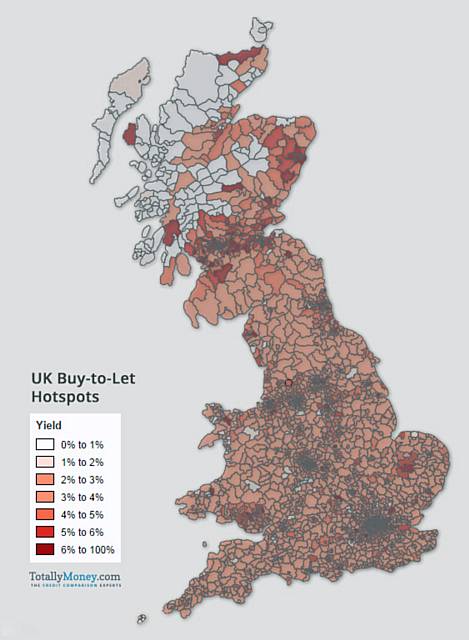

The buy-to-let interactive heatmap released by TotallyMoney.com, the credit comparison experts, shows would-be property moguls an at-a-glance view of the potential yield from rental properties across more than 2,600 UK postcode districts.

- Sheffield city centre (S1 postcode) delivers a table-topping 11.1% yield, closely followed by Aberdeen (AB24) and Bradford (BD1) offering yields of 10.4% and 9.2% respectively

- Northern and Scottish investors have the best chances of realising a buy-to-let yield above the national average of 4.17%

- The average 3.4% buy-to-let yield for London postcodes is lower than for any other UK city.

The TotallyMoney.com Buy-to-let Yield Interactive Heatmap:

http://www.totallymoney.com/buy-to-let-yield-map/

...reveals the yield achievable in more than 2,682 postcode districts across England, Scotland and Wales, with data compiled from analysis of 751,600 properties on the market for sale or rent.

In the past year, nationwide demand for rented accommodation has soared by 18%, and by 50% in the capital, while supply has dwindled by 19% (3% in London), turning the rental market into an increasingly competitive jungle – there are up to seven tenants viewing each property.2

Winners and losers

Sheffield (S1) tops the table of the highest yielding places to invest in buy-to-let property with a yield of 11.1% and a decent pool of available properties.

| Post town | Postcode | Median monthly rent |

Median asking price |

No. of properties for sale |

Yield |

|---|---|---|---|---|---|

| Sheffield | S1 | £645 | £69,995 | 108 | 11.06% |

| Aberdeen | AB24 | £1,200 | £138,000 | 121 | 10.43% |

| Bradford | BD1 | £459 | £60,000 | 45 | 9.18% |

| Manchester | M14 | £980 | £134,950 | 370 | 8.71% |

| Southampton | SO17 | £1,300 | £181,000 | 104 | 8.62% |

| York | YO1 | £1,929 | £268,750 | 74 | 8.61% |

| Greenock | PA15 | £425 | £59,998 | 150 | 8.50% |

| Aberdeen | AB11 | £1,150 | £170,000 | 77 | 8.12% |

| Glasgow | G44 | £494 | £75,000 | 171 | 7.90% |

| Paisley | PA3 | £425 | £65,000 | 168 | 7.85% |

While scraping along at the bottom of the table we find South Kensington, London SW7, with a buy-to-let yield of only 1.56%.

| Post town | Postcode | Median monthly rent |

Median asking price |

No. of properties for sale |

Yield |

|---|---|---|---|---|---|

| London (Chelsea) | SW3 | £3,120 | £1,795,000 | 447 | 2.09% |

| Tonbridge | TN8 | £1,101 | £637,500 | 108 | 2.07% |

| Beaconsfield | HP9 | £2,496 | £1,475,000 | 127 | 2.03% |

| Dartmouth | TQ6 | £650 | £385,000 | 290 | 2.03% |

| London (Mayfair) | W1 | £3,683 | £2,187,500 | 778 | 2.02% |

| Worcester | WR2 | £402 | £240,000 | 281 | 2.01% |

| Bishop’s Stortford | CM22 | £913 | £549,950 | 117 | 1.99% |

| Macclesfield | SK10 | £650 | £400,000 | 586 | 1.95% |

| Bournemouth | BH13 | £1,700 | £1,050,000 | 436 | 1.94% |

| London (South Kensington) |

SW7 | £2,925 | £2,250,000 | 447 | 1.56% |

Geographical divide

The study reveals a clear geographical divide between The North and The South with northern regions coming out on top and The South East showing particularly poorly. Nine out of the 10 highest yielding postcode districts are in Scotland and the North/Midlands regions. The 10 lowest yielding postcodes, with the exception of Macclesfield in East Cheshire, are all in Greater London and the South East.

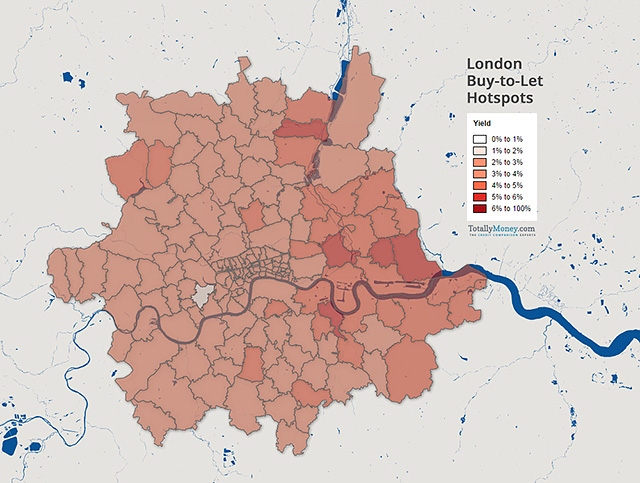

No capital gains

Investors looking for higher yields would do well to avoid investing in buy-to-let properties in London: the average yield for London properties is 3.4% compared to the 4.17% national average.

It’s not all bad news for the capital – Plaistow tops a short list of London postcodes in which above average yields can still be earned.

| Area | Postcode | Median monthly rent |

Median asking price |

No. of properties for sale |

Yield |

|---|---|---|---|---|---|

| Plaistow | E13 | £1,300 | £270,000 | 261 | 5.78% |

| East Ham | E6 | £1,248 | £270,000 | 329 | 5.55% |

| Edmonton | N18 | £1,249 | £275,000 | 98 | 5.45% |

| Deptford | SE8 | £1,495 | £340,000 | 201 | 5.28% |

| Bow | E3 | £1,517 | £360,000 | 353 | 5.06% |

Source: TotallyMoney.com analysis

Nigel Pocklington, CEO of TotallyMoney.com comments: “Although property prices are rising faster in London than the rest of the UK, this growth rate hasn’t been mirrored in rent prices. Property investors looking for high yields on rental developments could see the best returns from northern cities or Scotland.”

Do you have a story for us?

Let us know by emailing news@rochdaleonline.co.uk

All contact will be treated in confidence.

Most Viewed News Stories

- 1Camera trial reveals the shocking truth about drivers scrolling and texting with children on board

- 2Council announces plans for Hopwood Hall Estate, - as angry Hopwood DePree holds "urgent" public...

- 3Parking war sparked after council install controversial double yellow lines

- 4MP spotlights ‘hidden horror’ of domestic abuse with dedicated surgery

- 5"Week of action" begins as GMP get tough on anti-social behaviour

To contact the Rochdale Online news desk, email news@rochdaleonline.co.uk or visit our news submission page.

To get the latest news on your desktop or mobile, follow Rochdale Online on Twitter and Facebook.